In the rapidly evolving landscape of digital payments, businesses are presented with an array of options to facilitate their financial transactions. Among the most prominent players are Venmo and PayPal, two widely used payment platforms that have gained immense popularity due to their convenience and user-friendly interfaces.

Choosing the right payment platform for your business is crucial, as it can impact customer satisfaction, financial efficiency, and overall growth. In this article, we’ll delve into the comparison of Venmo and PayPal to help you decide which platform integrates better with your business.

The Basics of Venmo and PayPal

Venmo and PayPal share a common lineage; PayPal Holdings, Inc owns both platforms. However, they cater to slightly different markets and have distinct features that can significantly influence their compatibility with your business.

Venmo

Venmo was initially launched as a peer-to-peer (P2P) payment app, primarily targeting individuals who wanted a convenient way to split bills, pay friends, and share expenses. Over time, Venmo has evolved to include some business features, such as the ability for merchants to accept payments. Its strength lies in its social component, allowing users to share payment activity and interact through comments and emojis, creating a more engaging experience.

PayPal

On the other hand, PayPal is a veteran in the digital payment space and is widely recognized for its versatility and global reach. It serves individuals and businesses, offering a comprehensive suite of payment solutions. From simple P2P transfers to sophisticated e-commerce integrations, PayPal covers a broad spectrum of financial needs. Its extensive list of features includes invoicing, subscription management, and customizable checkout options.

Integration with Your Business

When deciding between Venmo and PayPal for your business, assessing how well each platform integrates with your operations and aligns with your goals is essential. Here are some factors to consider:

1. Customer Demographics

Understanding your target audience is critical. If your customer base consists primarily of younger individuals accustomed to Venmo’s ease and social aspects, incorporating it as a payment option could enhance the user experience. On the other hand, if your customer base spans various demographics and geographies, PayPal’s broader appeal might be more suitable.

2. E-Commerce Functionality

PayPal’s advanced e-commerce functionalities can be a significant advantage for online businesses. It offers integrations with various e-commerce platforms, simplifying the checkout process and enhancing the customer journey. While Venmo is making strides in this area, PayPal’s comprehensive e-commerce solutions are more established.

3. Payment Security and Fraud Protection

Both platforms offer security measures, but PayPal’s experience in the field lends it an edge in terms of robust fraud protection and dispute resolution mechanisms. This can be particularly crucial for businesses handling high transaction volumes or valuable goods.

4. Payment Types and Fees

Consider the types of payments your business frequently processes. Venmo excels in small, casual transactions, while PayPal accommodates a wider range, including recurring payments and larger purchases. Compare the fee structures of both platforms to ensure they align with your business model and financial strategy.

5. Integration Ease

Evaluate how seamlessly each platform can integrate with your existing systems. PayPal’s extensive API library and documentation simplify embedding payment functionalities into your website or app. Venmo’s integration options are growing, but they might offer different customization and flexibility than PayPal’s.

Choosing between Venmo and PayPal hinges on your business’s unique needs and priorities. If fostering engagement through social interactions and catering to a younger demographic is vital, Venmo could be a compelling choice. On the other hand, if your business requires a robust e-commerce infrastructure, global reach, and sophisticated payment solutions, PayPal emerges as the frontrunner.

Case Studies: Real-World Scenarios

Let’s explore a couple of hypothetical business scenarios to provide a deeper insight into the practical implications of choosing between Venmo and PayPal.

Scenario 1: Boutique Clothing Store

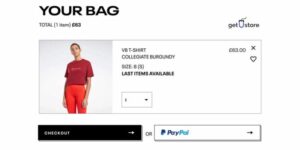

Imagine you own a boutique clothing store targeting a wide range of customers, from fashion-savvy millennials to older professionals. You offer both in-store and online shopping options. In this case, integrating PayPal to build your shopping website would offer distinct advantages.

PayPal’s well-established reputation, global reach, and e-commerce capabilities ensure a seamless shopping experience for customers across different demographics. The ability to accept various payment methods, including credit cards and PayPal balances, would cater to a broader customer base.

Additionally, PayPal’s secure checkout process and dispute resolution mechanisms would instill confidence in your online shoppers, helping to reduce cart abandonment rates.

Scenario 2: Food Truck Business

Now, consider that you run a trendy food truck that frequents college campuses and local events. Your target audience primarily comprises tech-savvy students and young professionals. In this scenario, integrating Venmo could be a strategic move.

Social interactions and a seamless mobile experience that align with the lifestyle of your customers. Venmo’s option for customers to split bills and share their food truck experiences with friends would resonate with your target demographic.

By incorporating Venmo as a payment option, you create a buzz around your business and encourage word-of-mouth recommendations through social features.

Conclusion

There is no one-size-fits-all answer in the ongoing battle of Venmo vs. PayPal. Both platforms offer unique strengths that can contribute positively to different types of businesses. The choice ultimately depends on your business’s requirements, goals, and customer base.

It’s essential to thoroughly analyze your business operations and target audience before making a decision. Consider customer demographics, e-commerce needs, payment security, and integration ease. Additionally, keep an eye on evolving trends and technological advancements in the digital payment landscape.

Remember that selecting the right payment platform is not a static decision. As your business grows and evolves, your needs change. Regularly reassessing your payment strategy and considering new features and improvements offered by both Venmo and PayPal will ensure that you always provide the best payment experience for your customers.

Ultimately, your business’s payment integration success relies on aligning the platform’s capabilities with your business’s unique identity and goals. By making a well-informed choice between Venmo and PayPal, you’re setting the foundation for a seamless and efficient financial journey for you and your customers.

Leave A Reply